About

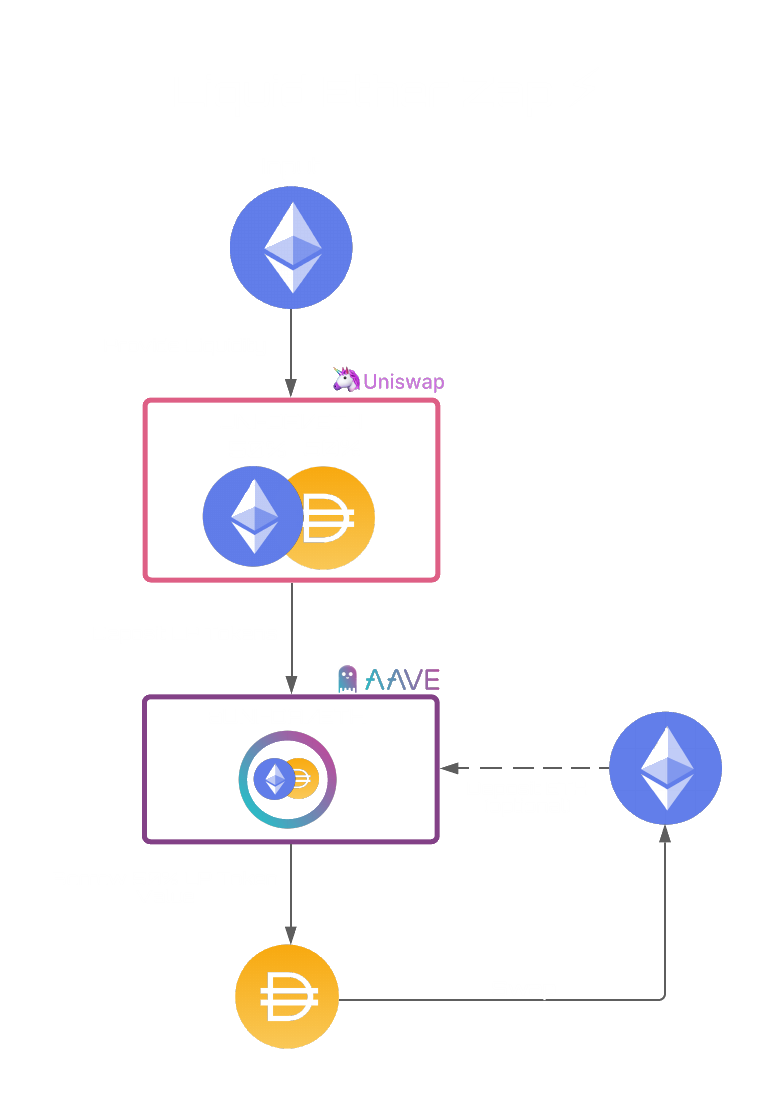

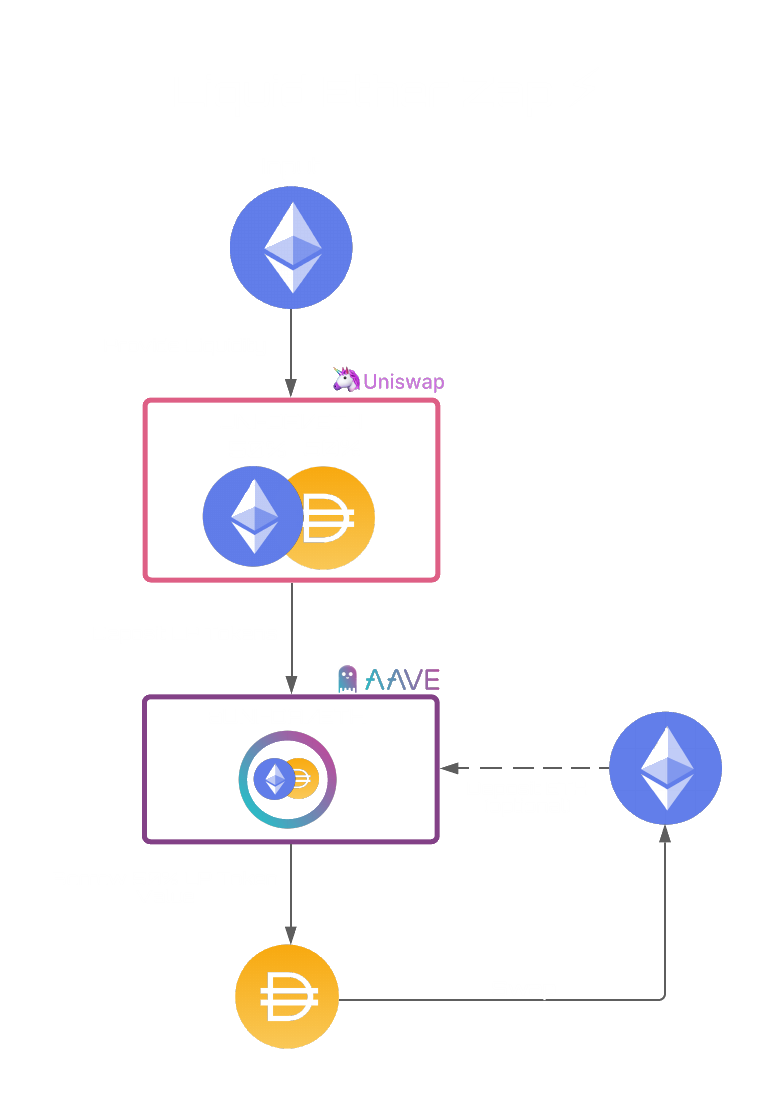

The Liquid Ether Zap allows you to go from ETH into a liquidity pool while maintaining ~100% exposure to the price of ETH with the click of a button. Below is an example for the Uniswap ETH/DAI pair, for a more detailed explanation see here.

Disclaimer

There are two main risks associated with executing this zap:

Smart Contract Risk

Liquidation Risk

This zap involves borrowing DAI against the value of your newly minted Uniswap liquidity tokens. It's important to note that your borrowing position can be liquidated if the value of borrowed DAI exceeds the liquidation threshold for the liquidity tokens. You can track the health factor of your borrowing position on the Aave Borrowings Dashboard . Be sure to keep enough assets deposited to keep your Health Factor above 1. A fantastic way to do this is by using an automated tool called HAL. By using the Aave Recipe on HAL, you can have it notify you by email, Discord, Slack, Telegram, or Twitter when your Health Factor crosses a certain threshold.